Get the free form 4136

Show details

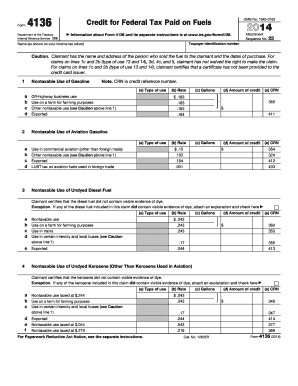

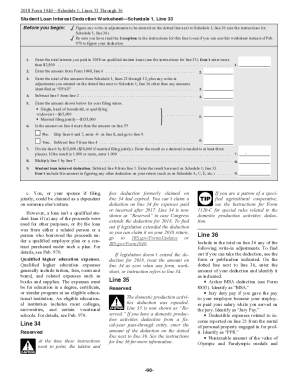

244 For Paperwork Reduction Act Notice see the separate instructions. Cat. No. 12625R Form 4136 2010 Page 2 Kerosene Used in Aviation see Caution above line 1 trade taxed at. Claimant has attached the Certificate for Biodiesel and if applicable the Statement of Biodiesel Reseller both of which have been edited as discussed in the Instructions for Form 4136.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 4136 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4136 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 4136 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 4136. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form 4136

How to fill out form 4136:

01

Begin by obtaining a copy of form 4136 from the Internal Revenue Service (IRS) website or your local IRS office.

02

Fill in your personal information, including your name, address, and social security number, at the top of the form.

03

Enter the tax year for which you are filing the form in the designated section.

04

Report the amount of fuel you consumed that is eligible for a tax credit. This could include gasoline, diesel fuel, ethanol, biodiesel, or other alternative fuels.

05

Calculate the total amount of gallons used, and enter this figure in the appropriate section on the form.

06

Determine the eligible tax credit amount by referring to the instructions provided with the form. Different types of fuels have different credit rates.

07

Multiply the total number of gallons used by the corresponding credit rate to calculate your total tax credit.

08

Include any other necessary information or attachments as instructed on the form.

09

Review your form for accuracy and completeness before signing and dating it.

10

Send the completed form 4136 along with your tax return to the IRS.

Who needs form 4136:

01

Individuals who use certain types of fuels in their business, farming, or other qualifying activities may need to fill out form 4136.

02

This form is used to claim a tax credit for the use of fuels that qualify for credit under specific circumstances.

03

Those who have used alternative fuels, such as ethanol or biodiesel, may find it necessary to file form 4136 to receive the appropriate tax credit.

04

Individuals who have consumed a significant amount of gasoline or diesel fuel in their eligible activities may also need to use this form to claim the credit.

05

It is crucial to consult the IRS guidelines and instructions to determine whether you meet the criteria for filing form 4136 and to ensure correct completion of the form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4136?

Form 4136 is a tax form used in the United States for claiming a tax credit or refund for federal excise taxes paid on certain fuels. This form is typically used by farmers, fisherman, and other taxpayers engaged in specified activities that involve the use of fuels subject to these excise taxes. The purpose of Form 4136 is to calculate the amount of credit or refund that can be claimed based on the taxes paid.

Who is required to file form 4136?

Form 4136, titled "Credit for Federal Tax Paid on Fuels," is typically filed by individuals and businesses that have paid certain federal excise taxes on fuel. This includes farmers, fishermen, and other taxpayers who use fuels for specified purposes, such as off-highway business use, nontaxable use, or blending of certain liquid fuels. The form allows eligible taxpayers to claim a credit for the federal fuel taxes they have paid.

How to fill out form 4136?

Form 4136 is used to claim a fuel tax credit for certain types of fuel used in commercial aviation, farming, and off-highway business use. To fill out Form 4136, follow these steps:

1. Obtain a copy of Form 4136 from the official IRS website or at your local IRS office.

2. Begin by entering your name, taxpayer identification number, and the tax year at the top of the form.

3. Next, complete Part I: Section A if you are claiming a credit for tax paid on gasoline or diesel fuel used on a farm for farming purposes. Provide the requested information, including the total gallons of fuel used on the farm during the tax year and the total amount of tax paid.

4. If you are claiming a credit for fuel used in commercial aviation, complete Part I: Section B. Enter the number of gallons of fuel purchased or used for qualified commercial aviation during the tax year, and the total tax paid.

5. If you are claiming a credit for fuel used in off-highway business use (such as fuel used in forklifts or generators), complete Part I: Section C. Provide the requested information regarding the total fuel used and total tax paid.

6. In Part II, determine the amount of credit you are eligible for by referencing the appropriate tables included in the instructions for Form 4136. Multiply the gallons of fuel used by the applicable credit rate to calculate the credit amount for each section (A, B, and C).

7. Add up the credit amounts from each section and enter the total in Part III: Total Credit.

8. Complete the remaining sections of the form, including any additional calculations required in Parts IV and V.

9. Sign and date the form at the bottom, and provide your phone number if requested.

10. Attach Form 4136 to your annual tax return when filing.

It's important to note that Form 4136 may have additional instructions or specific requirements based on your particular situation. Therefore, it is recommended to consult the instructions accompanying the form or seek professional tax advice if needed.

What is the purpose of form 4136?

Form 4136 is used by taxpayers to claim the fuel tax credit for certain types of fuel used in their trade or business. The purpose of this form is to provide a way for individuals or businesses to get a credit for federal excise taxes paid on fuel that is used for specific purposes, such as in off-highway business use, farming, or other types of non-highway use.

What information must be reported on form 4136?

Form 4136, also known as the Credit for Federal Tax Paid on Fuels, is used to claim a credit on the federal tax paid on certain fuels.

The information that must be reported on Form 4136 includes:

1. Taxpayer identification: Name, Social Security Number (SSN) or Employer Identification Number (EIN), and address.

2. Fuel type: Specify the type of fuel for which the credit is being claimed (gasoline, diesel, kerosene, aviation gasoline, etc.).

3. Fuel purchases: Report the amount of fuel purchased for which the credit is being claimed. This includes both the taxable and nontaxable gallons of fuel.

4. Fuel usage: Indicate the usage of the fuel purchased. This includes the number of gallons used for off-highway business uses, uses in certain intercity or local buses, uses in school buses, uses for farming purposes, and other eligible uses.

5. Fuel credits: Calculate the credit amount by multiplying the eligible gallons of fuel used by the applicable credit rate.

6. Certification: The taxpayer must certify that the information provided is accurate and that any tax credits claimed are valid.

7. Supporting documentation: Attach any necessary supporting documentation required to substantiate the credit claim, such as copies of invoices, fuel receipts, or other records.

It is important to carefully review the instructions provided with Form 4136 to ensure accurate reporting and compliance with the IRS guidelines.

When is the deadline to file form 4136 in 2023?

The deadline to file Form 4136 in 2023 would be April 18, 2024. Typically, the deadline for filing form 4136 aligns with the regular tax filing deadline, which is April 15th. However, if April 15th falls on a weekend or holiday, the deadline is usually extended to the next business day. Therefore, in 2023, as April 15th is a Saturday, the deadline would be moved to the following Monday, April 17th. However, since April 17th is a legal holiday (Emancipation Day) in Washington D.C., the deadline is further extended to Tuesday, April 18th, 2023. It's always recommended to double-check with the IRS or a tax professional to ensure accurate and up-to-date information.

What is the penalty for the late filing of form 4136?

The penalty for the late filing of Form 4136, which is used to claim fuel tax credits, is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. However, if the return is filed more than 60 days after the due date, the minimum penalty is either $210 or 100% of the unpaid tax, whichever is smaller. The penalty can vary depending on certain circumstances, so it is best to consult the official IRS guidelines or seek professional tax advice for specific situations.

How do I execute form 4136 online?

Completing and signing form 4136 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in form 4136 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form 4136, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit form 4136 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form 4136.

Fill out your form 4136 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.