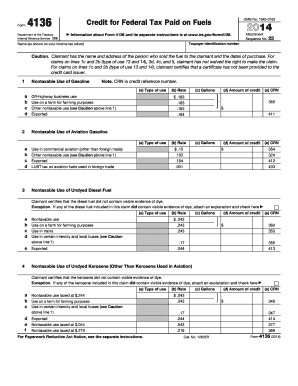

Who needs Form 4136?

Most kinds of fuel in the U.S. are taxed. But there are some cases when the use of fuels isn’t taxable and a person may claim a credit with Form 4136. These cases are as follows:

- Gasoline used for business purposes in a vehicle which isn’t registered for highway use

- Fuel used in farming, in a boat engaged in commercial fishing

- Exported fuel

- Under kerosene used at home for cooking, heating or lightning

Everyone who has been using fuel in the above-mentioned circumstances may fill out Form 4136.

What is Form 4136 for?

Form 4136 is a Credit for Federal Tax Paid on Fuels. This is a document that may be used by everyone who is eligible to claim a fuel credit. The tax credit that you calculate on Form 4136 reduces the amount of tax withheld.

Is Form 4136 Accompanied by Other Forms?

Generally, Form 4136 is attached to the tax return. But 4136 is an annual fuel tax credit. You may use Form 8849 or Form 720 to claim a fuel credit earlier.

When is Form 4136 Due?

Form 4136 must be completed and attached to the tax return by April 18th, 2017.

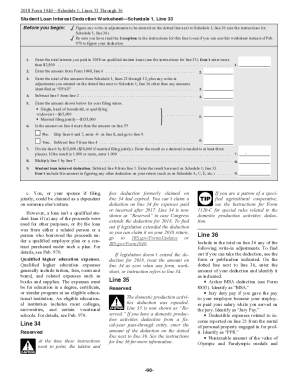

How do I Fill out Form 4136?

To claim a fuel credit you will have to do some calculations. The form lists many fuel use cases when tax isn’t applied. For every such case you must enter the number of gallons used and the amount of credit. The form has three pages that comprise twelve fuel use categories. Read detailed instructions to the Form 4136 for the exact calculations.

Where do I Send Form 4136?

Since 4136 form is attached to the tax return, it is also sent to the IRS by mail or electronically.